INVESTMENT PORTFOLIOS

investment portfolios -

growing net worth

we don't mess around when it comes to investments. we are not trend chasers, but long-term investors focused on building your net worth. we use human judgment, selecting companies with future-facing ideas and strong fundamentals. after all, we invest in what we believe in, and we invest with you.

the objective is to grow net worth, not just assets

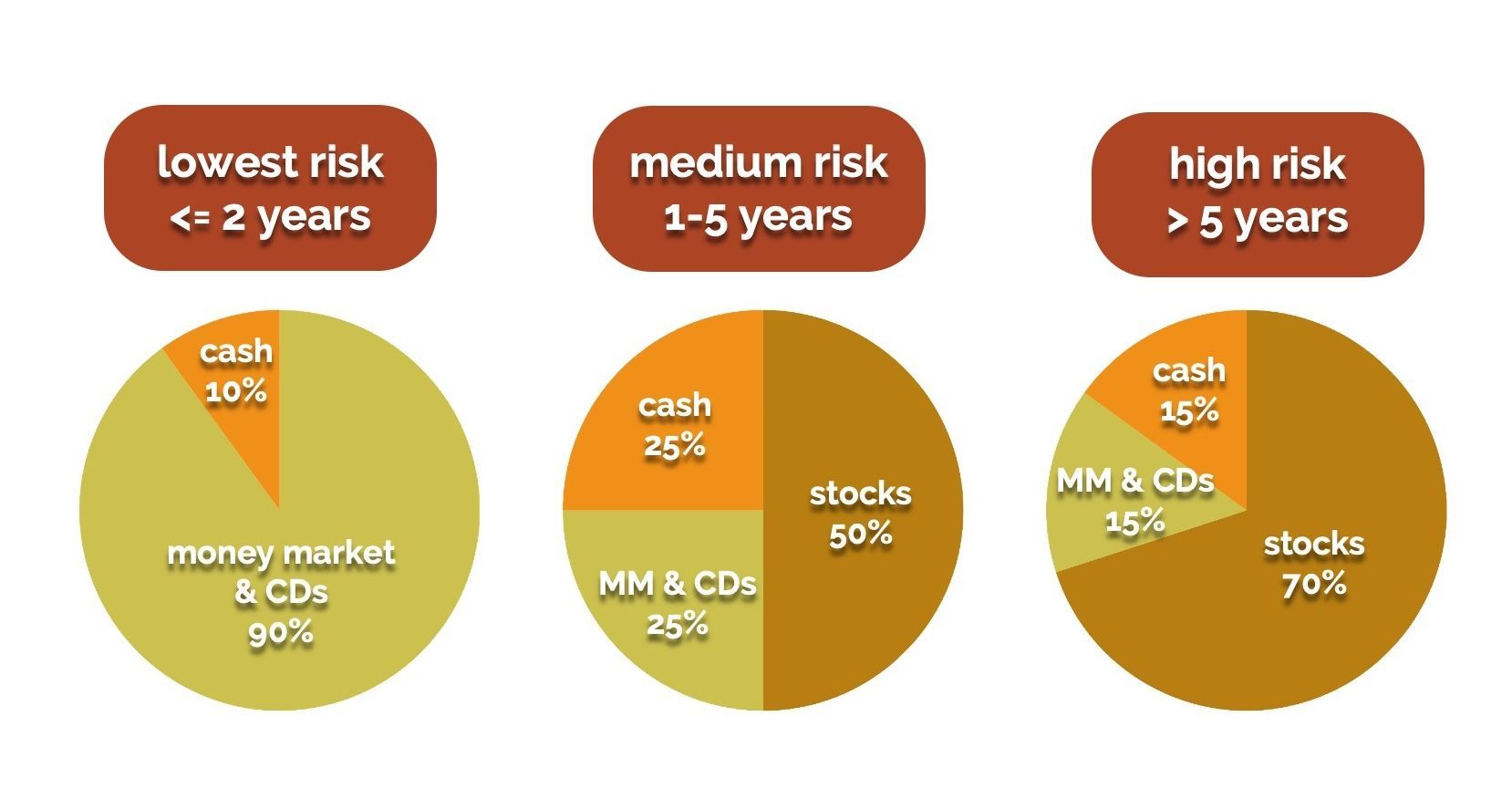

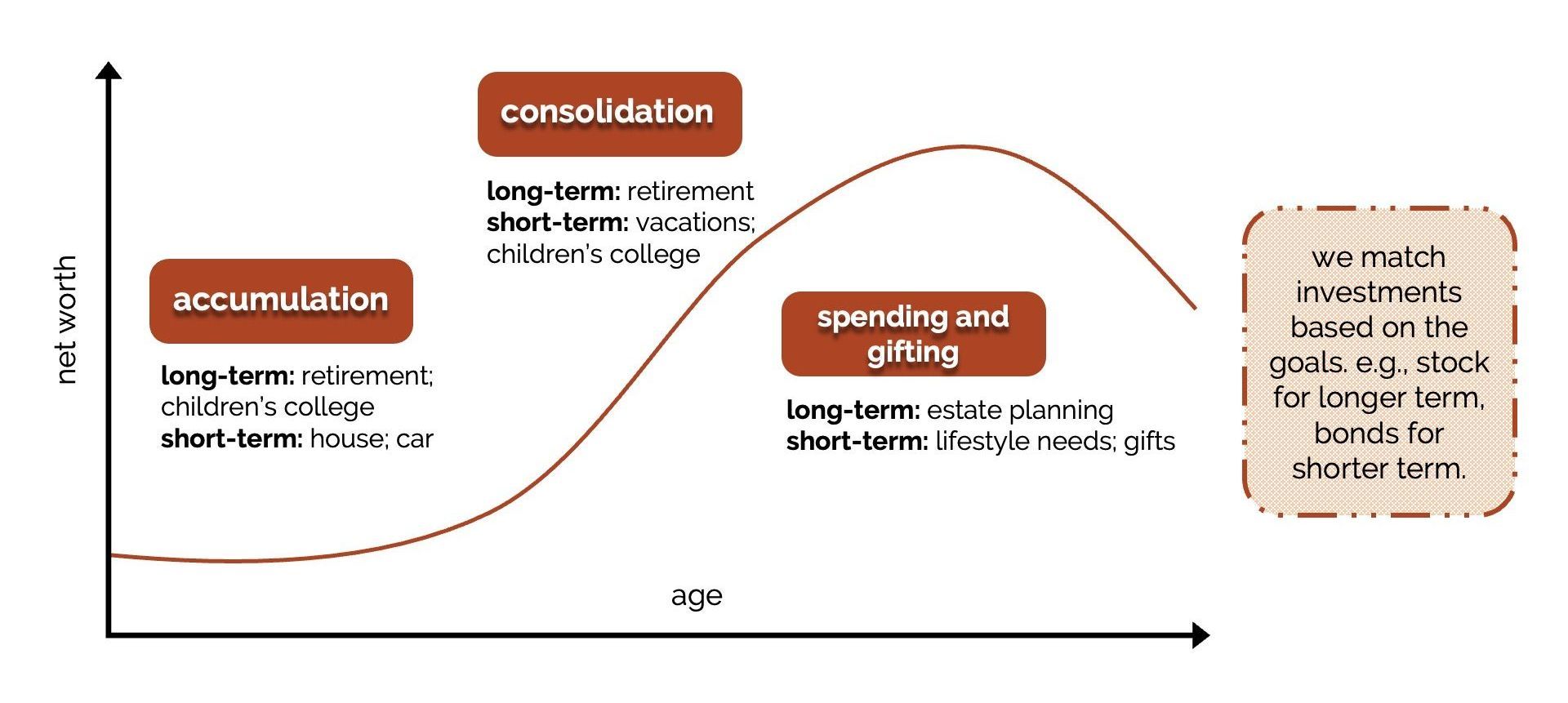

we match investments based on your personal goals, including short-term and long-term, with the aim of ultimately building up your net worth! we put our money where our mouth is, so we adhere to a very strict investment criteria when choosing stocks to invest in.

how we pick our stocks & investment criteria

we are long-term investors holding our portfolio names for more than 3 years on average, adhering to a strict, no-nonsense investment criteria.

our current portfolio dividend yield: 7.5%

1.

we focus on companies that serve real needs, has strong mgmt., revenue, profits, and cash flow.

2.

we screen for high global dividend yields (targeting 5%+) - this is an indicator of low price.

3.

dividends provide steady income while waiting for price growth.

4.

we evaluate stock prices over 5-year trends, not short-term movements.

5.

we research growth catalysts (e.g., debt reduction, innovation).

our fee structure

- 0.5% per year for cash, CDs, and money market portfolios.

- 1.25% per year for 100% stock portfolios.

- your fee is a weighted average based on your stock / bond mix.

- charged quarterly, based on your average balance that quarter.

formula: (average quarterly balance x weighted annual fee %) ÷ 4

we have never raised our fees since inception in 2000!

example

your asset allocation is: 70% stock, 30% money market.

thus, your weighted average annual fee is:

(1.25% x 70%) + (0.50% x 30%) = 1.03%

say, for example, on january 1, your account value is $99,000, and on march 31, the account value is $101,000. this makes your average account value for that quarter: $100,000.

we calculate your quarterly fee as shown below:

$100,000 x (1.03% ÷ 4) = $258

how we set up your accounts at Charles Schwab

1. we review your current investments vs. goals to determine your stock/bond allocation mix

2. open Schwab accounts electronically using your personal info

3. you receive email to e-sign forms and set up login

4. next day: we link your bank (MoneyLink) + transfer assets via ACAT

all transfers take about 4-6 days to complete. once the funds arrive, we then invest it in our global stock portfolio per your stock bond mix for that account.

how the stock markets work

before 1996, stocks were traded manually with an average holding period of 8 years (a healthy buy/hold strategy).

today, the average holding period of a stock is only 20 seconds! with 90% of trades buying or selling the S&P 500 or Nasdaq, and completely computer generated based on internet / news sentiment.

in essence, the stock market today trades like

one highly volatile stock, rather than a collection of individual stocks – as it did under the old buy-and-hold strategy.

our focus: finding undervalued stocks with long-term growth potential.

we don’t compete with computer algorithms – we outthink them! because being human, we can imagine the future in ways that machines can’t.